As the new year rolls in, we end an unprecedented year for the stock market and paradoxically, one of the slowest volume years on record for real estate transactions. The volatile trifecta of inflation, high interest rates, and low inventory continues to keep the housing market more frozen than not, with little relief in sight for 2025. Ironically, both the good news and the bad news is that the U.S. economy continues to be strong, which is keeping inflation on the sticky side, and thus, interest rates higher than desired. With that in mind, here’s what you should know about housing predictions for 2025, as per Fannie Mae:

“From an affordability perspective, we think 2025 will look a lot like 2024, with mortgage rates above 6 percent, home price growth easing from recent highs but staying positive, and supply remaining below pre-pandemic levels,” said Mark Palim, Fannie Mae Senior Vice President and Chief Economist.

PREDICTION #1: MORTGAGE RATES

Due to the strong economy and sticky inflation, interest rates will most likely remain at 6% or above, with bouts of volatility. Per Yahoo Finance, “Ten Fed officials estimated two cuts next year, three predicted one, three said three cuts, and one saw four cuts.” Translation? Expect no more than two cuts, and then be pleasantly surprised if there are more. Further translation? Getting below that 6 percent benchmark will feel like a miracle.

PREDICTION #2: VOLUME OF HOUSING SALES

Home sales will remain at near 30-year lows, depending on where you live. States with more inventory and more new construction will see better volume. Currently these states include Florida, Texas, the Mountain West and Pacific Northwest. These states are otherwise known as belonging to the “sunbelt states.”

PREDICTION #3: NEW HOME SALES TO LEAD THE WAY

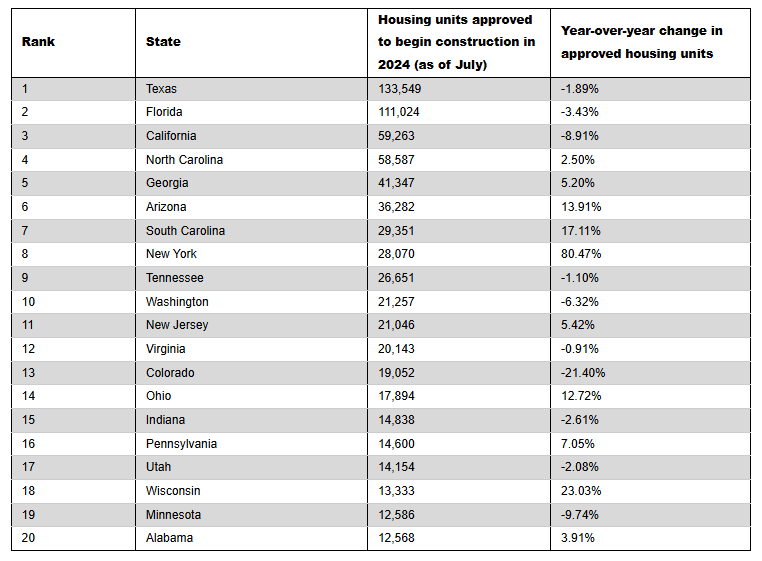

States where there is less red tape on new construction will lead the way in volume of sales when it comes to the housing market. These states are, in order of rank: Texas, Florida, California, North Carolina and Utah. (Per National Mortgage News)

PREDICTION #4: NATIONAL HOME PRICE APPRECIATION

Overall, national home price appreciation will decelerate to a relatively cool 3.6 percent in 2025. That number sounds low, and comparatively, it is. But it rode in on the heels of an average rate of appreciation since 2020 that was an unprecedented 47 percent. “The boom witnessed in the early years of the 2020s has outpaced not only the growth of the 1990s and 2010s — but is now threatening to surpass the entirety of the 2000s.” (Businesswire.com) Compare this number of 47% to what used to be considered an “average” national home appreciation of 10.4 percent prior to the pandemic and it’s easy to see that today’s homeowners have realized historically high home appreciation.

PREDICTION #5: RENT WILL CONTINUE TO TREND DOWN

Over the past year we’ve seen rent prices start to trend down, and this is expected to continue through 2025. One reason is that many of the vacation rentals that were snapped up during Covid are no longer holding their own, and some strapped second-and-third-home owners are starting to sell. Combine this with increased new construction and the reality of supply and demand and you get dropping rental prices. Also significant is the exodus of remote workers from big cities, which has lowered rents in those areas. Rent growth is expected to be between 2 and 2.5 percent in 2025, a marked decrease from the average rate of 18% in 2021.

PREDICTION #6: THE WILD CARD

One last consideration to throw into this mixed bag of possibilities: The newly elected in-coming president. It’s anyone’s guess as to how the housing market will be affected by the incoming administration. On the one hand, policies towards more relaxed legislation to get new housing approved could bolster the housing market. This could particularly benefit first time home buyers. On the other hand, tax cuts, tariffs and deportations could play a part in the economy that is difficult to predict. The bottom line is that 2025 is looking to be an interesting year and the best we can do is play the cards we’ve been dealt in the best way we know how.