Maybe you think knowing about homeowner’s insurance shouldn’t be part of your job as a real estate professional. But think again. The ability of your clients to obtain and afford homeowner’s insurance has a direct impact on real estate transactions. Between 2021 to 2023, homeowner’s insurance has gone up an average of twenty percent and continues to rise. Meanwhile, the ability to obtain new homeowner’s insurance has gone down by thirty-five percent. Regardless of whether you are working with buyers or sellers, homeowner’s insurance can be an obstacle. You can’t get a mortgage without one. And even if the property is an all cash deal, no one wants to take such a risk. Here’s what you need to know about today’s homeowner’s insurance:

THE “CLIMATE” OF HOMEOWNER’S INSURANCE

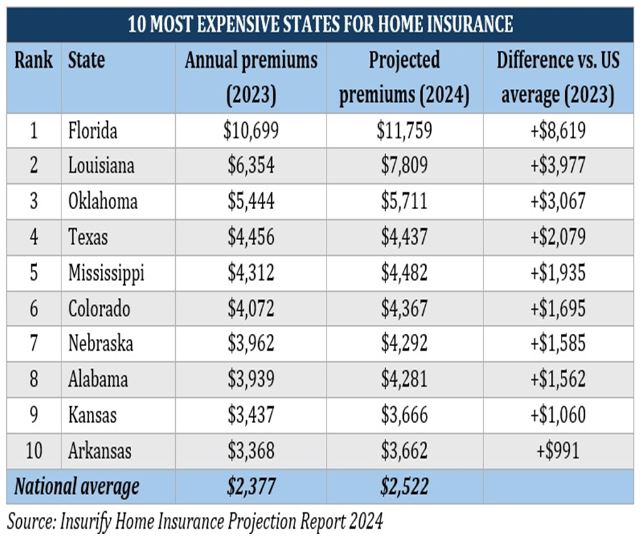

The inability to easily obtain affordable homeowner’s insurance is becoming a problem everywhere. Currently, Florida has the most expensive homeowner’s insurance nationwide, coming in at an average of $11,000 per year. Many have historically flocked to the state of Florida for lower taxes and what used to be cheaper housing. However, the the rising cost of insurance is making this once affordable retirement destination less so. By comparison, California comes in at an average of $1453. But fire insurance is separate and can easily cost upwards of $6000 per year if you live in a high-fire area.

Regardless of what state you live in, every state is experiencing the negative side effects of climate change and extreme weather events. This directly affects the cost of homeowner’s insurance and even the ability to obtain it. It also affects the rental market. The Commercial Property/Casualty Market Index Survey for Q3 2023 shows that insurance premiums have been rising for 24 straight quarters. In the third quarter of 2023 alone, commercial property insurance rose 17.1% on average. Premiums for properties in higher risk areas saw even greater jumps — up to 45.4% in some areas.

DOES EXPENSIVE INSURANCE AFFECT PROPERTY VALUES?

This can have an effect on real estate values in dramatic ways. Some homeowners are forced to move away from areas which used to be affordable, like Paradise, CA. Retirement areas are particularly vulnerable to rising homeowner’s insurance costs. With housing inventory at all time lows – and not expected to improve anytime soon – rising insurance costs only add fuel to the fire. States like Florida, Texas, Louisiana and Oklahoma are four of the hardest hit states when it comes to pricey homeowner’s insurance. This is due to the threats of extreme weather damage like flooding and tornados. In Texas, homeowners insurance rates have climbed the most in the country, on average, 59.9%.

Real estate experts agree that home insurance isn’t the top driver of home prices compared to mortgage rates or housing inventory. As long as the housing shortage remains, it’s expected that home prices will continue to rise despite the rising cost of homeowner’s insurance. Still, the cost of insurance has the power to influence what buyers are willing to pay over the long term. Some buyers, especially first-time buyers, are simply being priced out of the market. The rising cost of homeowner’s insurance only adds to that problem. (Read: What Homeowner’s Need to Know About Climate Change)

WHAT REFORM COULD LOOK LIKE

As the problem escalates it’s clear a solution must be found. Thus far, so-called FAIR plans attempt to do just that. These plans are created by the state governor and legislature and are private associations. Their day-to-day operations are controlled by insurance companies that currently offer insurance in the state. They are not funded by taxpayers. They provide coverage to individuals and businesses who are unable to obtain insurance in the regular market. The states that have their own FAIR plans include California, Florida, Hawaii, New York, and North Carolina. These are last resort insurance programs, such as Citizens Property Insurance Corporation in Florida and The California FAIR Plan. However, these programs are, for many, prohibitively expensive and only offer bare-bones coverage.

THE FUTURE OF HOMEOWNER’S INSURANCE

Most experts agree that what’s happening in states like Texas, California, Louisiana and Oklahoma is not unique. It is becoming a national problem as climate change and natural disasters become more commonplace in all states.

In answer to the problem the National Association of Insurance Commissioners created the Climate Risk and Resiliency Task Force in 2020. This includes the participation of 43 state insurance commissioners. As natural disasters increase along with the cost of replacement materials, the goal is to keep the insurance industry afloat.

There is hope, however. For example, California’s insurance commissioner has proposed a new plan to stabilize the market by 2025. As such, homeowners may have less trouble getting their homes insured. States and the insurance industry will figure something out sooner rather than later because insurers can’t stay in business unless they can actually provide insurance. If insurers want to be in a profitable industry, they have no choice but to make homeowners insurance work better for everybody. This, however, may take time for the new reality to force change in an industry famously known for its implacability.

EXCEPTIONAL AGENTS ARE PREPARED

It is likely that the topic of homeowner’s insurance will come up during your transaction, especially if you serve an area prone to natural disasters. In which case it could be one of the main areas of focus. It’s becoming more common that the first question many buyers ask is, “How much does it cost to insure this property?” It has gotten to the point that many buyers won’t even consider looking at a home until they know the cost of insurance. Thus, your job as an exceptional real estate professional is to get out in front of it. Come prepared with answers so that no time is wasted – yours or your client’s. Make sure you develop a strong relationship with a couple of great insurance agents and then have them on speed dial. If you are listing, make sure you provide current home insurance quotes as part of your MLS package when listing the property. And don’t forget the benefits of suggesting a home warranty to the closing, which adds additional coverage and protection for a home’s major systems. It’s one less thing to worry about. Finally, get familiar and involved with your state’s insurance departments. Become a force for sustainable insurance reform – it’s just one more area where you can learn, become a better agent, and add to your sphere of contacts.