“To know what you know and what you do not know, that is true knowledge.” – Confucius

As a real estate agent and business owner it’s important to have some knowledge of what may lay ahead. The market dislikes surprises and the spring-summer sell season surprised many with its lackluster sales and a housing market often described as “frozen.” Buyers and sellers alike faced strong headwinds such as unaffordable housing prices, higher than expected mortgage rates, and sky-high insurance and taxes. Meanwhile sellers struggled to adjust to a market that was less enthusiastic than in the recent past. The somewhat irrational exuberance seen in yesterday’s post-pandemic era has come and gone. This has resulted in an increase of 47% more delistings in June as unbelieving sellers pulled their homes off the market. What we know is that being aware of today’s market dynamics prepares you for tomorrow’s market realities, and hopefully fewer surprises. Following are things affecting real estate now that are likely to shape tomorrow’s market:

THE BIG PICTURE

The real estate market has a major impact on the overall economy. It is also the largest and most slow moving dynamic to track. Historically knowing when there will be a housing market downturn or a recession becomes known only after it’s either happening or already happened (think 2008). Back then the drivers were overbuilding, homes with low or underwater equity and irresponsible lending. Unfortunately we may be facing another round of questionable lending impacts on the market today. This is due to “quantitative easing” (QE) practices that took place during the pandemic. One such example is the effect of “loan workouts” and “modifications.” This particular program (the CARES Act) allowed payments on FHA mortgages to lapse for up to 360 days or more with no requirement for repayment. At the same time people with student loans were not required to continue payments. This QE relief program resulted in artificially high credit scores since defaults were not reported to credit bureaus. Today there are roughly 42.7 million people with federal student loans who are now required to fully resume payments without protection from default reporting as of last September. Statistics indicate that many are currently behind in payments, in active collections or defaulted altogether. The Department of Education is now authorized to pull student loan payments via wage garnishment and tax refunds may also be used to pay off defaulted loans. This combination of consequences would indicate that there is a population of people with home loans they can no longer afford now that full payment on both is required. These dynamics are likely to have some surprising impacts on the market ahead, and it’s anyone’s guess as to how that will play out, exactly.

Meanwhile, Wall Street has been going full steam ahead which could indicate a healthy population of folks able to cash out their stock options and afford to buy homes. The ongoing debate as to whether or not we’re in a housing and/or stock market bubble rages on, with too many nuances and hidden forces (like AI) to offer a simple answer. One thing’s sure: Wall Street and Main Street continue to operate independently of one another and seem to exist in different worlds.

HOUSING AFFORDABILITY

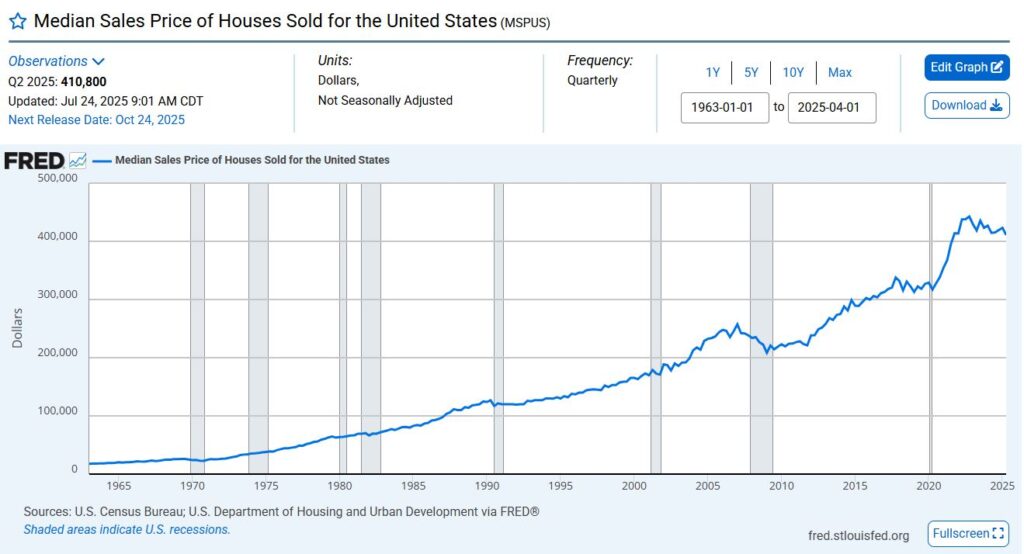

Someone making $80,000 today can comfortably (a relative term) afford a home that’s within the range of $275K to $300K. But today’s national median home price is roughly $420K – lower in some areas, like Jackson, MI ($268,667) but screamingly higher in others, like Silicon Valley (which comes in at a whopping $2 million dollars). It would seem that several things need to happen for the housing market to become unfrozen: Either home prices and interest rates must come down substantially or wages must come up to meet inflated costs. One sign that the market is becoming more balanced is that the rapid, double-digit home price appreciation seen in previous years is not expected to return. Instead, most forecasters predict a period of modest, single-digit growth in 2026. However, as more sellers become forced to sell due to life changes or financial necessity, it’s possible housing prices will tick down in response to the supply-demand dynamic. That combined with lower interest rates could make for a busy spring and summer sell season come 2026, with NAR predicting a 13% rise in existing home sales and an 8% increase in new home sales.

HOUSING INVENTORY

Opinions on inventory levels are mixed and depend on the area. Some continue to point to a housing shortage; others indicate a major uptick in inventory. What is beyond dispute is that there is definitely an affordable housing shortage. Several things point to inventory going up and thus affecting the supply-demand equation: The first is new construction which currently has about nine months of inventory. Many new homes are now sitting on the market. The second is more sellers listing homes because they no longer have a choice. The four Ds are usually at play here: Diapers, divorce, downsizing, and death–plus the call-back of employees into city offices and the possibility of increased mortgage defaults.

MORTGAGE RATES

According to Fannie Mae, Bankrate and NAR rates are expected to fall to 5.9% or 6% by the end of 2026. Factors affecting Fed cuts will continue to balance a razor-thin margin between inflation pressures and the employment market. This could result in buyers continuing to hang out on the sidelines until the end of next year, as they instead choose to hedge their bets and save money by renting as they hold out for continued rate drops. This in turn will make it harder on those sellers that must sell now, which could result in lowered sales prices as a way to lure buyers off the sidelines.

A familiar proverb based on the law of gravity says ‘what goes up must come down.’ As the near-insanity of the pandemic-era housing market roared its way through 2021 with its pinnacle reached sometime in 2023, we collectively held our breath waiting to see how much longer the rocket could keep going up…..and when it would finally, inevitably, run out of fuel. The good news is that, at least for the moment, the fall seems to be more of a drift buffered by a parachute, rather than an overnight downward spiral. It’s possible we’ll manage to elude a market downturn altogether and forces will combine for a healthy, vibrant and balanced real estate market that allows more families to participate in the American Dream of homeownership.

Note: If you want to learn more about market expectations, read the article The 18-Year Property Cycle.