“Success is built on the back of preparation.” -Unknown

April is right around the corner, which in the real estate industry is prime kick-off time for the 2024 sell season. This means any leads you made November through February are possible listings. Sixty percent (60%) of sellers spend up to three months preparing their homes, and your professional guidance will be highly sought after. And seventy-five percent (75%) of sellers contact an agent as soon as they start thinking about selling their home–think now. Meanwhile, inventory levels are expected to decrease by 14% (YoY) for 2024, and interest rates, though going down, remain one of the biggest challenges for both buyers and sellers. As we move into spring, keep these things in mind for sell season 2024:

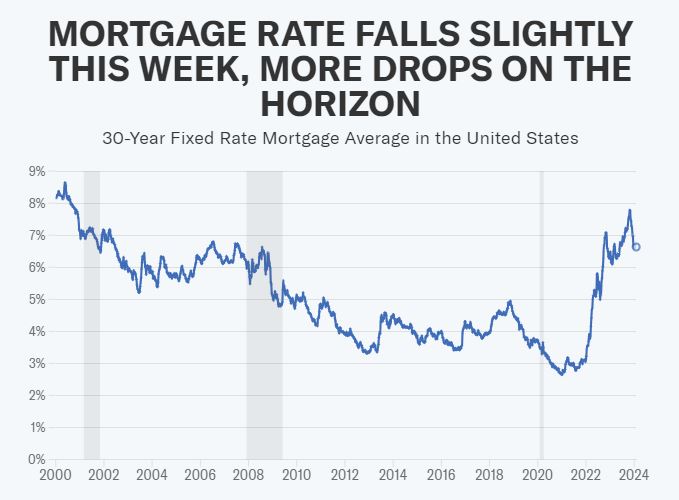

INTEREST RATES

As of this writing on the first day of February 2024, today’s rate for a 30-year fixed is 6.63%. Keep in mind that over 90% of homeowners with mortgages have rates under 6%, creating a “lock-in-effect” or “golden handcuffs.” Housing inventory reached a 28-year low in 2023 because of the lock-in-effect. Fannie Mae housing experts predict rates will fall below 6% by the end of 2024 to about 5.8%. If this comes to pass, expect a busy fall sell season for 2024. Once rates dip below the 5% mark things will really start to move. With more competition among sellers, expect to see improved price discovery as buyers and sellers operate in a more rational market.

MARKETPLACE DYNAMICS

Here are the things shaping today’s market and the markets to come and the resulting predictions:

- An aging population of Babyboomers impacting inventory, area population changes, and overall housing demographics

- The cost of Climate Change (more natural disasters like floods and fires making home insurance in certain areas prohibitively expensive and pushing populations into safer areas)

- Geopolitical Instability

- AI expansion into the economy

- Unfreezing of the housing market once rates drop into the low 5s

- Strengthening of the new construction market as builders buy down mortgage rates and pent-up demand grows

- Stabilization of the rental market as housing supply increases

- Stabilization of Inflation to 2% by 2026

The 54th annual gathering in Davos, Switzerland noted main economic concerns being the rise of AI, climate change, and threats to global economies due to cold-war-type geopolitics. However, consumer sentiment could continue to improve if AI became viewed as helpful, there was increased adaptation to climate change, elections were fair, and wars in between countries were contained.

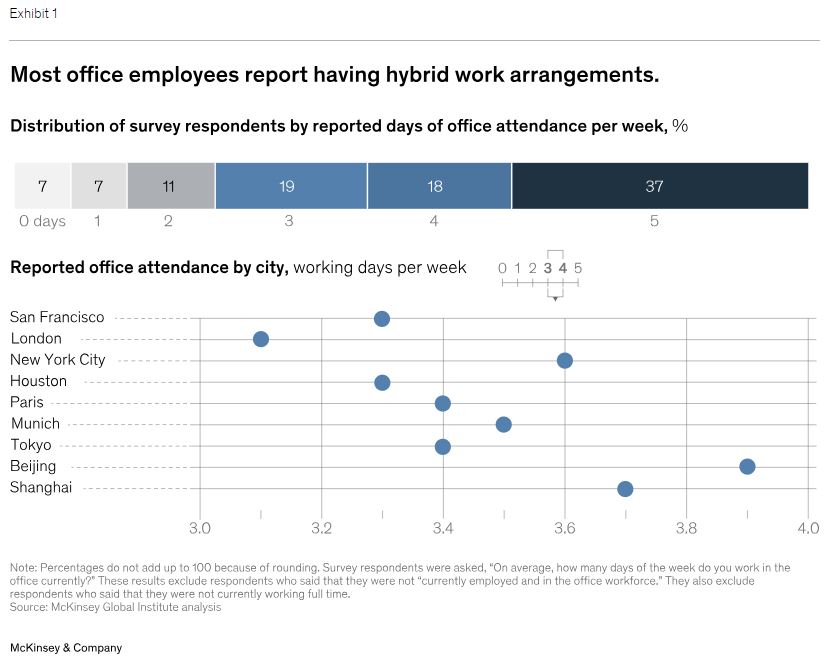

WORK & AUTOS

Covid-19 has forever changed the landscape of work to include the entrenchment of a hybrid work schedule. Ten of the largest cities showed less than half of office spaces being occupied in January 2024. As a result the value of commercial buildings are down approximately 40%, and the largest cities have lost up to two million residents in the last three years. Cities continue to struggle with creative ways to adapt to the new reality as they face substantial declines in their tax base. What this means for housing is a continued shift from urban to suburban or rural areas causing home valuations in those areas to rise. In addition, emphasis on work space and high-speed internet within the home will remain important selling points.

Meanwhile, the cost of owning a car has risen substantially, making life in the suburbs more expensive, in particular for those who commute. New cars rose by 30% to an average of $48 thousand dollars, with used cars up by 38% to an average of $27 thousand dollars. Auto insurance also rose, up by 20%. When it comes to autos, the golden rule to enable home ownership is to spend no more than 10% of income on auto-related expenses. This could prove to be tricky with today’s rising auto costs.

Meanwhile, the latest jobs report shows that substantially more jobs than expected were added to the US economy (353,000) with an unemployment rate holding at 3.7% and hourly wages increased by more than double what was expected at 0.06%. The labor market is a bright spot, inflation is holding steady at 2.9%, the stock market is experiencing a boom and it appears we’ve avoided recession. By all standards, as of today the US economy is looking very good indeed, except for housing, which is noted as “sticky” inflation at 4.6%.

TODAY’S HOUSING MARKET

Lack of inventory caused by a marked decrease in new construction since the Great Recession of 2008 and high interest rates are the main triggers affecting today’s housing market. Inventory should gain momentum once interest rates come down with sellers more likely to list and buyers better able to buy. Still, inventory is not expected to improve much over 2024 which will keep prices on the high side. As interest rates come down, demand for housing will go up, causing home prices to go up as well. Until new construction increases and more homes come to market, housing affordability will remain a challenge. As they say, ‘The best time to buy is five years ago, and the second best time to buy is now.’ This sentiment continues to ring true.

WHAT THIS MEANS FOR YOUR REAL ESTATE BUSINESS: Key Take-aways for 2024

The real estate market is complex and continually changing based on current events at home and around the world. Certainly no one predicted a global pandemic in 2020, and it’s likely there are other surprises with as much impact somewhere on the horizon. Which makes even the most expert predictions almost worthless. Still, it’s smart to learn from the past while casting an eye to the future. What’s true for now is that the US housing market continues to stabilize, our economy is growing, and interest rates are trending down. As such, expect 2024 to be a busy and (hopefully) prosperous year.

See more from our Blog

Get free marketing materials for your real estate business

Learn how an FNHW Home Warranty can sell homes faster and for more