It’s no stretch to conclude that Adjustable Rate Mortgages – known as “ARMs” – could be a viable solution for today’s housing affordability crisis. In recent history ARMS accounted for only 4-5% of all mortgage applications, but in April 2025 they reached a high of almost 10%. Buyers are increasingly desperate for ways to break into the housing market and realize the American Dream of homeownership. As such, agents would do well to dig in to the mechanics of ARM loans and get comfortable discussing the basic details. Here’s how to talk about ARM loans with your clients:

WHO CAN BENEFIT MOST FROM AN ARM LOAN?

(1) Starter Home Buyers: First-time buyers eager to stop spending on rent.

(2) Buyers that plan to sell within 5 – 7 years: Buyers that plan to sell within the fixed interest rate timeframe of an ARM can capitalize on a low initial rate without having to worry about future adjustments.

(3) Investment Buyers: Real estate investors who are doing fix and flips or rentals may use ARMs to minimize upfront costs, then sell the property or adjust the rent amount when rates change.

(4) Move Up Buyers facing a high interest rate market: During periods of elevated interest rates, ARMs might offer lower upfront costs and may even provide relief later if market conditions improve for buyers needing larger homes.

HOW DO ARMS WORK?

Once you begin to look into ARMs, you will quickly notice that terms like “5/6” and “7/6” dominate the conversation. A 5/6 ARM loan means that the rate is fixed for five years, after which the interest rate can adjust every six months for the remainder of the loan’s term. This means that your monthly payments could change after the initial five-year period as interest rates fluctuate. The same holds true for the 7/6 ARM version — fixed interest for seven years, with adjustments every six months for the remainder of the six years left on the loan.

THINGS TO WATCH OUT FOR

Of critical importance is that buyers should make sure that: (A) the adjustable interest rate is lower than fixed rates, otherwise why bother? And (B) that selling before the rate adjusts or being able to refinance when the rate adjusts is something that will be easy to do. Otherwise buyers can get caught in a possible scenario where their interest goes up every six months and stresses affordability. (Check out Knowing When An ARM Loan is a Good Idea.)

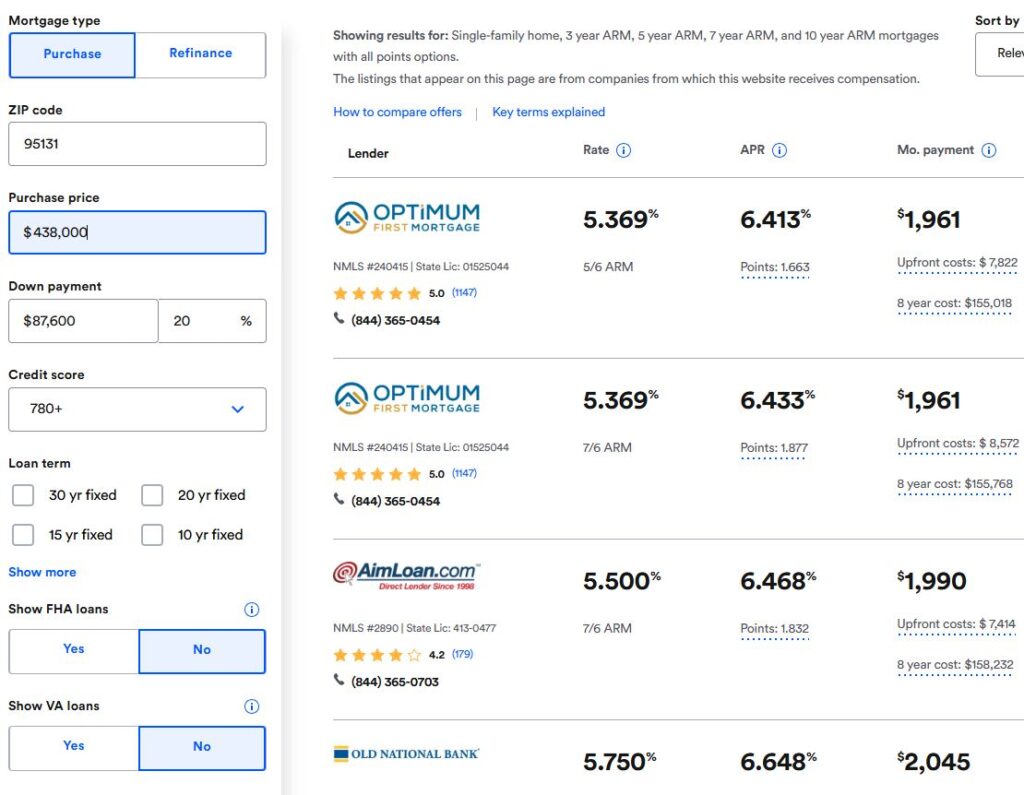

For a quick visual that makes things more clear, take a look at the following snapshot provided by Bankrate based on a sales price of $438,000 – roughly the current national median home sales price, with a 20% down payment:

Compare the adjustable rate mortgage scenarios as laid out in the image above to that of today’s 30-year fixed rate. Let’s use the same median sales price of $438,000 with 20% down at 6.96% interest rate (rate as of May 23, 2025). This scenario comes to a monthly mortgage payment of $2,997.83. As such, an ARM would save approximately $1,036.83 per month….wow! This could definitely make the difference between a buyer that could afford to purchase a home versus one that would be priced out of the market.

REMEMBER:

Agents don’t need to explain all the details of an ARM — that’s the loan officer’s role. But you can broaden the conversation by suggesting the possibility of an ARM and how it could be a useful and timely tool that could allow your buyers the ability to close the deal on a home.

ARM loans still carry the stigma of the 2008 market crash but things have changed since then. ARMs are now enforced with clear safeguards that help eliminate risks from 15-20 years ago. Today’s borrowers must show solid credit, verifiable income and the ability to repay — criteria that ensure ARMs are going to buyers who can afford them. Again, agents would do well to recognize this useful tool. When properly structured and carefully matched to the right borrower, an ARM loan could be the difference between your clients having their homeownership dream come true – or not.