Many of us take for granted our right to own a home. And most of us are also unaware of how government-backed loan programs help us achieve homeownership. Referred to as “The American Dream,” homeownership has become a rite of passage in this country. But history tells us widespread property ownership is a fairly recent phenomenon. Today, owning real estate is still recognized as the best way to build intergenerational wealth while also enjoying a secure place to live. Best of all, the right to own property is protected by our U.S. Constitution. Here’s how real estate became a “thing” in the United States:

A LITTLE ANCIENT HISTORY, PLEASE

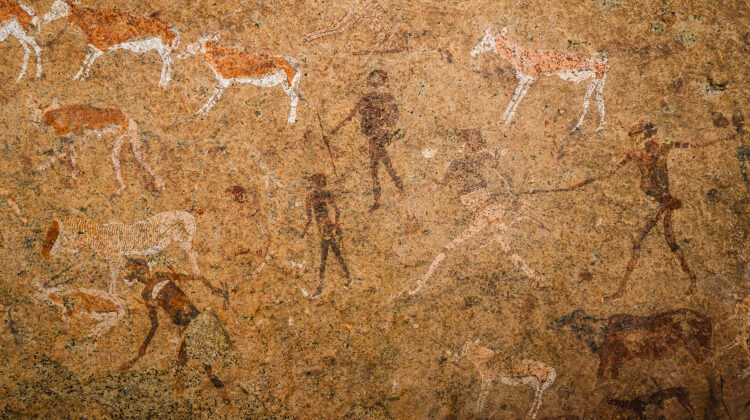

Spurred by the first Agricultural Revolution around 10,000 B.C.E., many cultures around the world went from nomadic hunter-gatherers to farmers. This transition required the construction of villages and homes governed by group cooperation. Land ownership was initially won by sheer force and held by the same. The victor–typically a king with an army–won the right to own the land. Peasants worked the land in exchange for a protected place to live. Over time, property ownership trickled down to aristocrats and merchants, and finally, to peasants–known in the United States as the “Middle Class.”

The term “Real estate” is defined as property consisting of land and the buildings on it, along with its natural resources, such as crops, minerals, water, and wild animals. In the U.S., you can own rights to the land but not a complete claim to the land itself. The term “real property” is the interests, benefits, and rights inherent in the ownership of real estate. Those rights include the legal right to accumulate, hold, delegate, rent, or sell the property. Every bit of real estate in the United States is owned by someone or something–either (1) an individual or corporation; (2) the Federal Government; (3) state and local governments; (4) and Native American tribes and individuals.

THE U.S. CONSTITUTION PROTECTS PROPERTY RIGHTS

The Fifth Amendment of the U.S. Constitution says that “….no person shall be deprived of life, liberty or property without due process of law; nor shall private property be taken for public use, without just compensation.”

The Fourteenth Amendment says, “…..nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.”

THE LOUISIANA PURCHASE, THE WILD WEST, AND HOMESTEADING

You might be wondering why the Louisiana Purchase had such massive significance when it comes to property ownership. In 1803 the United States purchased 828,000 square miles of land from France for about 4 cents an acre for a total of $15 million. As a result of The Louisiana Purchase, the U.S. doubled in size, expanding westward. This area resulted in 14 additional states, which were Louisiana, Arkansas, Missouri, Iowa, Oklahoma, Kansas, Nebraska, North Dakota, South Dakota, and parts of Minnesota, New Mexico, Montana, Wyoming, and Colorado. As a result, a significant push toward the west coast of North America began in the 1810s. Its lure was the belief in manifest destiny and economic promise. Pioneers traveled west using a network of trails whose wagon ruts can still be seen today. Just think: you wouldn’t have the option to ski Telluride today if not for the Louisiana Purchase.

The Homestead Act of 1862 accelerated the settlement of the west by granting each family 160 acres of public land for a minimal filing fee and five years of continuous residence and improvement. After five years on the land, the original filer was entitled to the property, free and clear, except for a small registration fee. From 1862 to 1934 the federal government granted 1.6 million homesteads and distributed 270,000,000 acres of federal land for private ownership. This made up 10% of all land in the United States. The American Dream was doing its job of investing its citizens into the fabric of being an “American” with the right and privilege of homeownership. (Homesteading was discontinued in 1976, except in Alaska, where it continued until 1986.)

THE NATIONAL ASSOCIATION OF REALTORS®

The first traces of a growing middle class began in the early 1900s as homeownership became more widespread. But it was beset with fraudulent land speculators using illegal methods to cheat people out of their savings. In response, the National Association of REALTORS® (N.A.R.) was founded in 1908 as a way to regulate the burgeoning real estate industry. The Code of Ethics was adopted in 1913 with the Golden Rule as its theme. Over time, real estate has become an extremely regulated and lawful industry and we are better off for it.

HELLO, FANNIE MAE: WHEN HOME OWNERSHIP [REALLY] BECAME A “THING”

Due to homesteading and a thriving economy, owning a house gained traction in the 1920s. But the Great Depression cut homeownership to a low of 43.6 percent by 1940. Nearly a quarter of the population lost their homes due to foreclosure, and banks no longer had money to make loans. To solve the problem the United States government created Fannie Mae and charged it with the mission to provide liquidity, stability, and affordability in the mortgage market. Fannie Mae helped banks finance a new type of mortgage which proved pivotal for widespread homeownership: the long-term, fixed-rate home loan. This expanded access to affordable homeownership, and the period between 1940-1960 saw homeownership rates rise to 61.9 percent. Today’s national average homeownership rate is 65%.

THE FUTURE OF HOMEOWNERSHIP

The Urban Institute predicts that homeownership in the United States will add 6.9 million additional homeowners by 2040. However, the national homeownership rate will decline 3 percentage points, from 65 percent to 62 percent. Though this sounds small, it will have a substantial impact on each successive generation in their prime homebuying and equity-building years. Communities of color will be especially hard-hit. The snapshot of America in 2040 shows 87.1 million homeowners. However, there would be 90.5 million homeowners if Gen Xers, Millennials and younger generations bought homes at the rate Boomers bought homes throughout their lives. That’s 3.3 million fewer homeowners–or 3.3 million more renters–who might not experience the wealth-building potential of homeownership.

What’s the answer to keeping The American Dream alive? There is no one-size-fits all, but clearly more affordable housing is needed, along with down-payment assistance and affordable interest rates on mortgages. Real estate in America became a “thing” due to the expansion of the Middle Class and its ability to obtain affordable long-term loans. Maintaining a robust real estate industry has everything to do with ensuring a healthy middle class demographic. That’s what will keep real estate a “thing” and the American Dream alive.