The American middle class was born roughly seventy-five years ago thanks to the GI Bill and government-backed loan programs. These programs spurred homeownership and consumer spending and culminated in the robust real estate industry we have come to expect. The opportunity for regular folks–commonly known as the “middle class”– to own homes is a defining feature of The American Dream. It’s also historically been the main driver of the real estate industry itself. As such, the careers of most real estate agents rely on the ability of the middle class to continue to buy and sell homes. Here’s how a strong middle class creates real estate wealth:

A MIDDLE CLASS MARKET CREATES SALES VOLUME

The middle class story has long been that as young people attain middle class status through education and job skills, they are then able to afford their first home. From there, the starter home would typically be swapped out for a larger family home, keeping real estate transactions humming along. Eventually, the upgraded home would then be downsized as folks became empty nesters and retirees. And the cycle would continue. With few exceptions, homeownership generates wealth and leads to more homeownership and upward mobility down the road. And this has historically kept the real estate industry a busy, productive place in which to forge careers.

THE MISSING MIDDLE

Statistics show that in 2023, 51% of Americans were in the middle class, down from 61% in 1971. In stark contrast, both upper income tiers and lower income tiers have simultaneously increased since 2021. Economists refer to this troubling trend as “the missing middle.” In addition to creating social stability and connected communities, a solid middle class tier is good for business and leads to increased volume of real estate sales. Afterall, cutting the proverbial pie into more pieces means more of us get some. But according to Bankrate, today’s homeowner needs a 6-figure income to afford a median-priced home in nearly half of U.S. states. In essence, today’s middle class, which represents roughly half of the population, is being priced out of the housing market. As of 2024, the NAHB (National Association of Home Builders) estimates that 77% of households are unable to afford a median-priced new home of $459,826. That’s a lot of buyers languishing on the sidelines.

While the uber-rich and luxury housing market may take the limelight and generate fortunes for those who work in that niche, it is the exception rather than the rule for most real estate careers. In keeping with the pie analogy, it’s a big pie but with far fewer pieces to go around. By contrast, the middle class real estate market is the engine that truly delivers when it comes to a variety of long-lived real estate careers and a healthy, solidly functioning society. Clearly, it is in everyone’s best interest to foster a robust middle class.

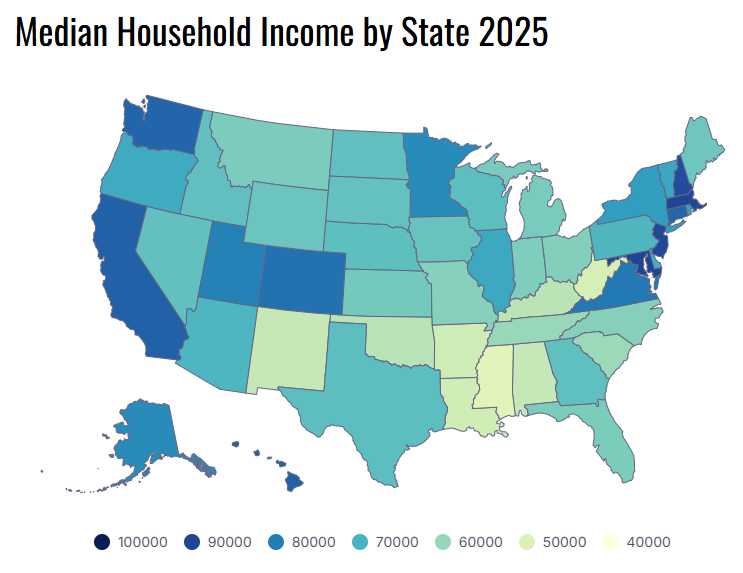

RATE YOUR STATE: Definition of the Middle Class by State

Middle class status can vary dramatically by state. A “middle class” designation in California will look completely different from a “middle class” status in West Virginia. Following is a quick snapshot of what’s considered “middle class” by state as based on median income:

| Rank | State | Median Household Income (2023) |

|---|---|---|

| 1 | Mississippi | $54,203 |

| 2 | West Virginia | $60,961 |

| 3 | Arkansas | $61,673 |

| 4 | New Mexico | $62,566 |

| 5 | Louisiana | $63,203 |

| 6 | Alabama | $64,237 |

| 7 | South Carolina | $65,737 |

| 8 | Ohio | $66,567 |

| 9 | Indiana | $67,782 |

| 10 | Kentucky | $68,082 |

| 11 | Tennessee | $68,365 |

| 12 | North Carolina | $69,330 |

| 13 | Oklahoma | $70,109 |

| 14 | Missouri | $70,461 |

| 15 | Illinois | $72,054 |

| 16 | Michigan | $72,882 |

| 17 | Florida | $73,103 |

| 18 | Georgia | $73,789 |

| 19 | Delaware | $74,524 |

| 20 | Nevada | $75,167 |

| 21 | Maryland | $75,868 |

| 22 | Arizona | $76,293 |

| 23 | Washington | $77,483 |

| 24 | Utah | $78,561 |

| 25 | Iowa | $79,065 |

| 26 | North Dakota | $79,116 |

| 27 | Colorado | $80,038 |

| 28 | New York | $80,150 |

| 29 | Maine | $80,230 |

| 30 | Pennsylvania | $81,251 |

| 31 | Wisconsin | $81,606 |

| 32 | Connecticut | $82,421 |

| 33 | New Jersey | $83,525 |

| 34 | New Hampshire | $84,284 |

| 35 | Hawaii | $85,696 |

| 36 | California | $86,512 |

| 37 | Massachusetts | $93,988 |

| 38 | District of Columbia | $108,210 |

Growing America’s middle class so that more people can afford to buy homes is a complicated and complex problem. What makes homeownership out of reach for much of the middle class is a lack of affordable housing inventory. This in turn is caused by high construction costs, inflation, high interest rates, stagnant incomes, and zoning restrictions. Growing the “missing middle” to revive The American Dream will take cohesive and collaborative efforts spanning a complex landscape of political entities.