The “Silver Tsunami” describes what could be a massive home turn-over created by Baby Boomers as they age out. The numbers are impressive: The US Census Bureau estimates a population of 73 million people aged 65 and older. Some predict this could radically alter the housing supply landscape. But others argue this coming wave won’t help housing supply much. The Baby Boomer generation spans nearly twenty years and thus homes that come to market will not appear all at once. Still, whether it’s a tsunami or a long, rideable wave, market expert Meredith Whitney (who successfully predicted the 2008 crash), believes the wave could hit this year. That begs the question: What will this mean for real estate in the United States and how can you prepare for the wave that’s coming? Following is everything you need to understand about the coming “Silver Tsunami”:

Over the past several years, about 10,000 Americans a day are turning 65, according to AARP. Zillow predicts that over 20 million homes could hit the market by 2037 thanks to baby boomers aging out. Whitney’s calculations predict it to be more like 30 million. Regardless, an impact will be felt.

WHO ARE THE “BOOMERS”?

“Baby Boomers” are typically classified as those born between 1946 and 1964, driven in large part by the end of World War II. Their coming of age was marked by historic economic prosperity and rapid technological progress. This created an explosion of the Middle Class. Foundational to this transformation was the birth of the American Dream. This has at its core the ability to own a home and build equity. Fast forward to today and it appears the American Dream may be in jeopardy. This is mainly due to inflation and a sustained housing shortage. Boomers are the parents of Gen Xers and Millennials, who face a vastly changing landscape of financial and political realities. The ability of younger generations to reach the American Dream is no longer a given. For over a decade the demand for housing has far outpaced supply. But perhaps that is all about to change as Boomers age out. Here’s what real estate agents can expect for the wave that’s coming:

HOW THE “WAVE” WILL AFFECT HOUSING SUPPLY

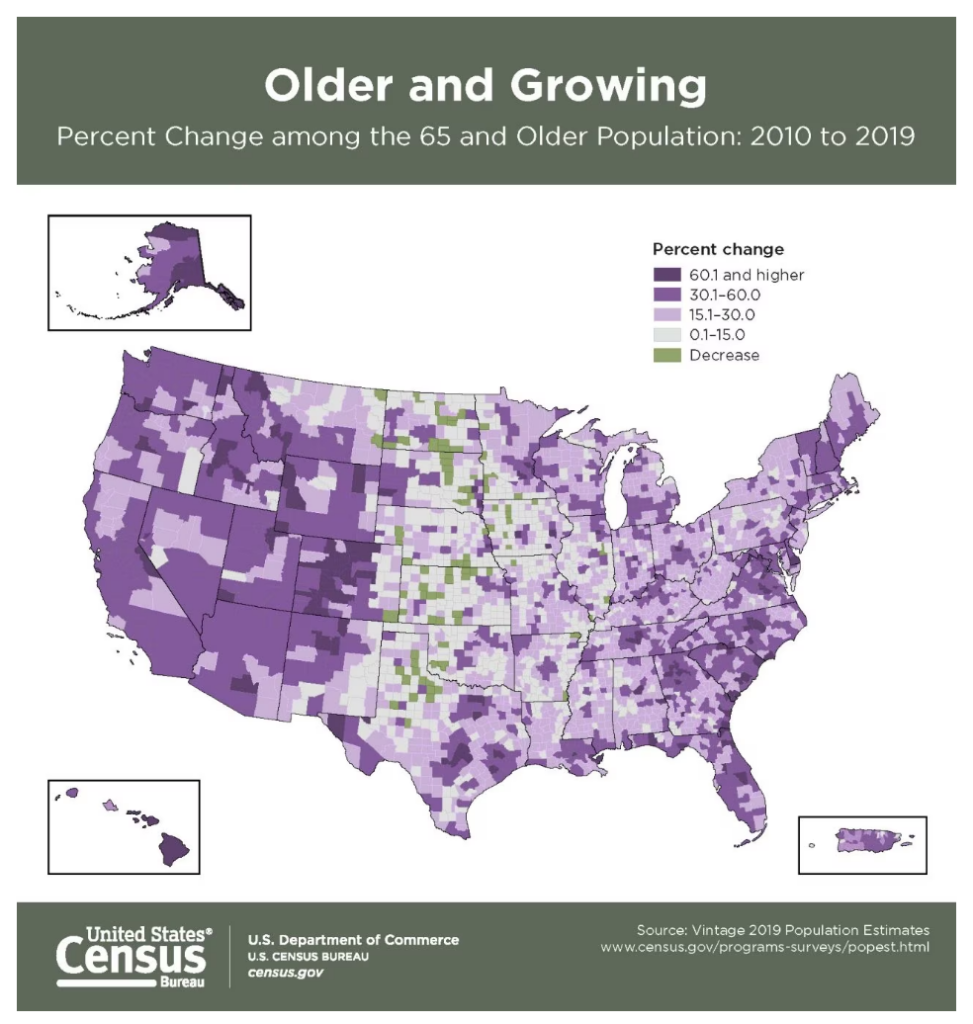

First off, the wave will affect some areas much more than others. Areas that typically cater to retirees, like Florida and Arizona, will feel the impact more and will have busier turn-over. The housing market is currently about 5.5 million units short of demand, according to the National Association of Realtors. That shortage keeps prices elevated and makes it harder for consumers to both find – and afford – homes. The “silver tsunami” effect naively predicts a flood of available homes hitting the market and thereby easing supply shortages. But those 30 million homes won’t hit all at once, and a good number will likely be passed on to heirs who may choose to keep them in the family as second homes. A 2022 report from the Mortgage Bankers Association and the Research Institute for Housing America predicts the change in housing supply will result in about 250,000 housing units per year, which is modest. In summary, the ageing out of Boomers is likely to be less impactful than many think when it comes to housing supply. And the probability of it lowering housing costs is simply not a reality–at least not in markets that have vibrant economies and aren’t already flooded by retired Boomers. (Get the latest Census Bureau stats on the 65-and-older Baby Boomer wave here.)

MARKETS THAT WILL BE HIT BY THE SILVER TSUNAMI

As mentioned, markets most affected by a “flood” of homes back on the market are likely to be areas that have historically attracted retiring Boomers. States like Florida and Arizona are sure to feels the effects of the ageing-out reality. The cities that will see the biggest boomer-related supply boosts by 2037 are Tampa, Orlando, Tucson, and Dayton, according to Zillow. Tampa is expected to see 33% of its currently owner-occupied homes released by that time. If you’re an agent in any of these areas, chances are you’ll be busy. But will this new influx of additional housing affect housing appreciation and pricing? It’s hard to say but the law of economics–namely that supply and demand affect pricing and nearly everything gets more expensive with time–says otherwise.

DOWNSIZING VS. THE “AGE IN PLACE” TREND

Retirement homes and 55-year and older communities cater to those wanting to downsize. But the AARP estimates that over half those aged 65 and older prefer to “age in place.” With better healthcare, improved longevity and Boomers’ ability to pay for what they need, it’s unlikely that the housing market will have more supply. Many Boomers are choosing to remain at home until they pass on. In addition, a good number of heirs are expected to hold onto their parents’ homes rather than sell.

KEY TAKE-AWAY

Zillow statistics estimate that the Silver Tsunami will only add about 440,000 homes annually by the second decade. There is an extreme housing shortage caused mainly by the 2008 bust which brought new construction to its knees. New construction has yet to make a full rebound towards fixing the housing shortage. And the so-called Silver Tsunami will do very little to solve that problem. The housing shortage can only be fixed by streamlining the permit process, increasing new construction and a greater emphasis on updating existing properties. In the end, renovation of existing properties could be the place to find the real silver.