It has been said “history repeats itself” and one thing’s certain: you can learn a lot from history. Real estate history is no different and has a cycle that more or less repeats. Once you understand this cycle you can anticipate changes ahead to better serve your clients and your business. The most studied and well-known cycle in real estate is over 90 years old and is called “The 18-Year Property Cycle.” Here’s the 18-Year Property Cycle and why you should know it:

THE GUY THAT “DISCOVERED” THE 18-YEAR PROPERTY CYCLE

In 1933, Homer Hoyt, an American economist, wrote a book called “100 Years of Land Values in Chicago.” Hoyt discovered that real estate goes through cycles of approximately 18-year intervals which have been happening for hundreds of years. Understanding this cycle will help you know what’s on the horizon so you can better plan your business strategy.

WHAT THE RESEARCH SHOWS

(1) Property prices tend to rise over the long run.

(2) Property prices don’t rise in a smooth and steady manner, but rather a series of ups and downs.

(3) The media doesn’t typically understand the property cycle and tends to interpret data short-term.

(4) Research shows the 18-year cycle always starts from a higher point than the previous one because land/property is finite.

BREAKING DOWN THE 18-YEAR CYCLE

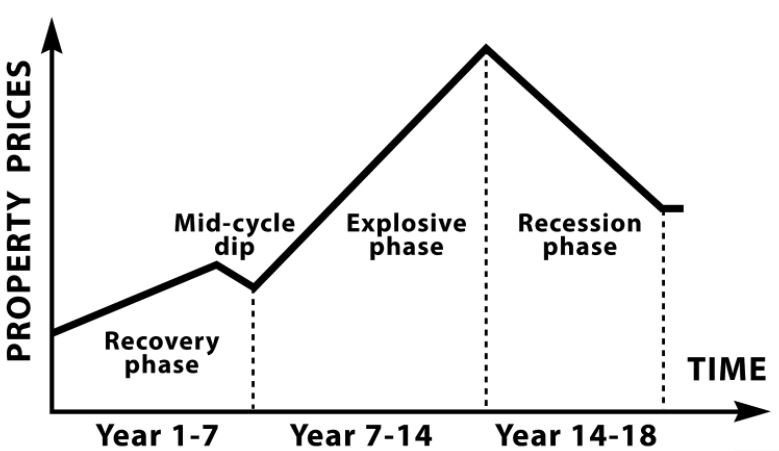

The 18 year cycle goes something like this:

(1) 7-YEAR EXPANSION/RECOVERY: Following a recession, property prices have fallen but then begin to stabilize and recover.

(2) 7-YEAR PEAK: People notice property prices are going up, banks loosen lending practices, and people begin speculating, which drives prices higher. (See Ricardo’s Law of Rent)

(3) 4-YEAR BUST: Prices are so high that most can no longer afford to buy and some are forced to sell. Borrowing becomes difficult, construction comes to a halt, businesses suffer and prices continue to fall until they hit that cycle’s “bottom.”

After the cycle reaches the bottom, a new cycle begins. All this amounts to roughly 14 years up and 4 down. Economists claim that the 18-year cycle has historically never been shorter than 17 years and never longer than 21 years on average. Established economies outside the U.S. tend to lag a year behind. The most important takeaway is that the new cycle always starts from a higher point than the previous one. (Property Geek)

THE 5 STAGES OF THE 18-YEAR CYCLE

There are stages within the 18-Year Property Cycle that look like this:

(1) Recovery Stage: Prices have hit the bottom and the recovery phase begins, often with increased construction of new buildings and homes.

(2) Mid-Cycle Wobble: Marked by slow and steady growth, prices are getting higher, then there is a mild, temporary fall.

(3) Second Expansion/Acceleration Stage: After the slight dip, the recovery phase resumes and prices start to rise again. Banks regain confidence and begin lending. This accelerated growth becomes explosive and reaches a peak. Prices rise faster than wages, attracting media attention, speculation, and refinancing for home upgrades, vacations, cars and the like. Group psychology takes over, further buying takes place, and prices go higher.

(4) The Winner’s Curse: Prices peak and the next recession is imminent. Expansion has become overgrown and there are many justifications as to why prices are now so high.

(5) Cyclical Peak & Crash: Reality sets in. Recession approaches. Prices continue to fall causing bankruptcies and forced selling. The exact start time of a downturn is always uncertain (economists agree the last one happened in 2008). The recession phase seems prolonged but eventually ends. And then the 18-year property cycle begins again with the next Recovery phase.

MARKET PSYCHOLOGY

Group reaction to a falling market shows that many tend to panic and sell when prices are falling. Conversely, people feel better about buying when the market is up. Econ 101 tells us this is the exact opposite of what we should be doing, but that can be easier said than done. The silver lining is that each cycle begins at a higher place than the one before so buying and holding will almost always serve those with long-term objectives (“buy and hold”). For most home buyers, the objectives are to have a home where memories can be made, families can be securely sheltered, and equity can be built (also known as The American Dream). Trying to time the market by waiting too long for prices to fall means homebuyers could miss out on potential appreciation on property values in addition to not having what they need at that time. Whether to buy or wait will often depend on the particular needs of your buyers and what they are able to afford at that moment in time. The thing to remember is that the 18-Year Cycle demonstrates that eventually, prices will not only rebound but appreciate, given enough time. Anyone looking back five to ten years ago would likely agree that home prices are more expensive today than they were then. And more importantly, that a drop in today’s market would still not bring prices to those of five and ten years ago.

5 BASIC RULES TO REMEMBER

(1) Don’t panic and sell when prices fall; history (and the 18-Year Cycle) show they will most likely rebound and actually increase during the next cycle.

(2) Don’t take on excessive debt that may force you to sell at the wrong time.

(3) Don’t get carried away during the Winner’s Curse Stage when prices are at their highest.

(4) Don’t pay too much attention to the noise of the media and of panicked investors.

The combined effects of the pandemic, politics and geo-political unrest make today’s marketplace feel complicated and uncertain. Understanding the 18-Year Property Cycle can bring some measure of sense to an otherwise uncertain world.